After the second bottoming out of US crude oil, it oversold and rebounded. Beware of breaking through again under demand constraints

- 2025-05-02

It is expected that 135000 new non farm jobs will be added in the United States in April, with an unemployment rate of 4.2%

- 2025-05-02

Short term trading strategy for major foreign exchange currencies on May 2nd

- 2025-05-02

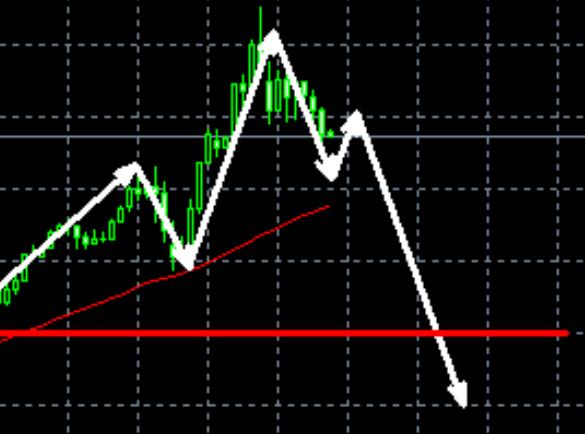

Gold is still in a weak stage, and the consolidation rebound continues to be bearish!

- 2025-05-02